SENIORS

Medicare Supplement

Also known as Medigap coverage, this coverage fills the financial gaps.

What is a Medicare Supplement?

Medicare Supplement, commonly referred to as “medigap”, is a medical insurance plan purchased through private insurance companies which covers certain copays, coinsurances, and deductibles in original Medicare.

Medicare Supplement Eligibility

To be eligible for Medicare Supplement insurance, you must be:

- Enrolled in Medicare Parts A & B (Original Medicare)

- 65 or older, or have a disability

Standardized Benefits

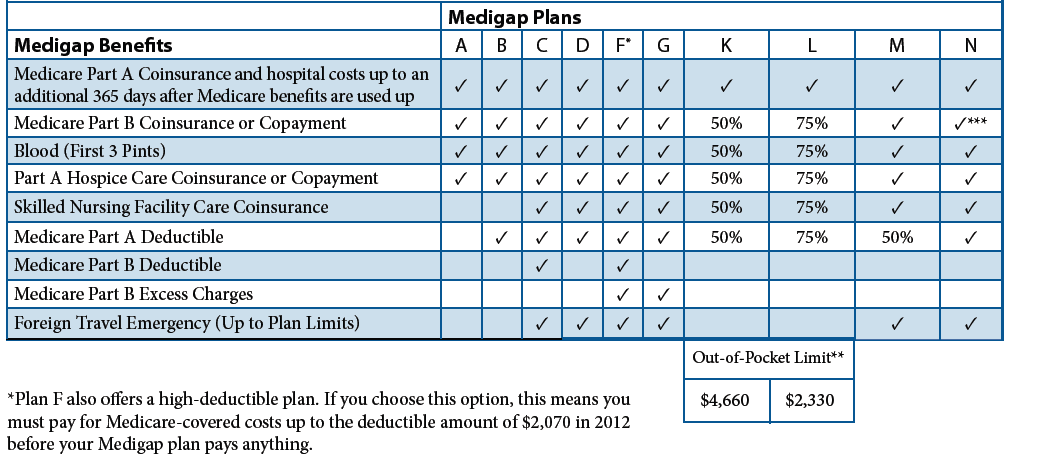

In 1990 legislators passed a reform act to standardized medicare supplement plans and provide a minimum benefit. Currently, there are 10 Medigap plans available for purchase: Plan A, B, C, D, F, G, K, L, M, and N.

Plan C and F

Legislation passed in 2015, known as MACRA, stipulates that effective Jan. 1, 2020, all newly eligible Medicare beneficiaries cannot sign up for a supplemental plan that covers the Medicare Part B deductible.

This means that Plans C and Plan F will no longer be available to newly enrolled Medicare beneficiaries.

Medicare Supplement Rights

Medicare offers certain rights to its beneficiaries that allow beneficiaries the right to purchase, change or drop coverage without repercussions.

Guarantee Issue Right

During your six-month Medigap Open Enrollment Period, you have the right to buy any Medigap policy offered in your state without having to answer medical questions.

This is usually the best time to purchase a plan because you will not be subjected to pay higher premiums for using tobacco products, nor will you be denied coverage due to your medical condition.

Trial Right

Another type of right is called a trial right, which lets you buy or switch back to a Medigap policy within the first year of either joining a Medicare Advantage plan or buying a Medicare SELECT policy.

Best Medicare Supplement Companies

Due to the fact that most Medicare beneficiaries must go through underwriting to switch from one insurance company to another, you want to be sure that you choose a great company from the start.

That’s why we have compiled a list of the Best Medicare supplement companies.

Frequently Asked Questions

Does Medigap Include Dental Or Vision Coverage?

Can I change medigap plans at anytime?

Find out if Medigap is Right for You

Our Medicare Experts have multiple insurance companies available to you.